THE CLIENT’S REQUEST

In a very competitive market, the company asked us to evaluate their entire commercial product range to:

- determine which factors of the marketing mix influenced brand performance and identify the levers that contributed to business growth;

- analyze the price positioning and elasticity;

- evaluate the ROI of advertising activities and determine the opportunities for growth through focused initiatives;

- define how to increase market share over the competitors.

THE CHALLENGE: EVALUATE THE INTERACTIONS OF MARKETING ACTIVITIES, THROUGHOUT THE ENTIRE PRODUCT PORTFOLIO, TO OPTIMIZE INVESTMENT ALLOCATION BASED ON THE PROFITABILITY AND GROWTH POTENTIAL OF THE DIFFERENT PRODUCTS.

PROJECT DEVELOPMENT

The analysis was broken down into three phases, each implementing a different tool from the CoreDecisionCloud platform:

- Marketing Mix Modeling

- Portfolio Modeling

- Core Forecast

PROJECT DEVELOPMENT

The analysis was broken down into three phases, each implementing a different tool from the CoreDecisionCloud platform:

- Marketing Mix Modeling

- Portfolio Modeling

- Core Forecast

The analysis covered a two-year period and used/integrated several sources of data:

Scanner market data:

An analysis of the entire marketing mix across the entire product portfolio in the FMCG channel (sales by volume and value, base price, distribution, promotions)

Communication Activities

- Traditional Media – Grp and investment on TV

- Online Media – visits, investments: Display, Web TV, searches

- Below-the-Line Activities: analyzed by type and investment

- Promotional Activities: promotional coupons distributed in-store

Dati dei concorrenti

- Grp of advertising campaigns on TV and other media

- Primary Below-the-Line activities

Integrated with research on Brand Equity.

The analysis covered a two-year period and used/integrated several sources of data:

Scanner market data:

An analysis of the entire marketing mix across the entire product portfolio in the FMCG channel (sales by volume and value, base price, distribution, promotions)

Communication Activities

- Traditional Media – Grp and investment on TV

- Online Media – visits, investments: Display, Web TV, searches

- Below-the-Line Activities: analyzed by type and investment

- Promotional Activities: promotional coupons distributed in-store

Dati dei concorrenti

- Grp of advertising campaigns on TV and other media

- Primary Below-the-Line activities

Integrated with research on Brand Equity.

MARKETING LEVERS EVALUATED

Price: price elasticity for each individual product and format was measured in order to determine the most profitable positioning for each of the items, depending on the format.

Promotions: 3 products were identified on which to increase price cut from 20 to 25%. Activation calendar was also set in accordance with television flights.

Communication: TV branding campaigns over the past 3 years proved to be neither effective nor efficient; whereas Product campaigns, which explain the specific usage and benefits of the various specialty products, continue to prove effective. In particular, we:

- determined the ROI for the different SKUs and the synergic effects across the different media and activities

- identified which products to push through communication

- evaluated the most effective creativity

- determined the GRPs needed to develop the proper TV pressure

Below-the-Line: our analysis identified the opportunity to expand BTL activities and, in particular, the distribution of promotional coupons, offering product samples and discounts upon multiple purchases, in order to stimulate product trial.

Digital: the analysis highlighted the need to re-examine all online word-of-mouth activities, because they were not successful.

PORTFOLIOMODELING: A COMPLETE ANALYSIS OF THE IMPACT OF ALL MARKETING LEVERS, BOTH TANGIBLE AND INTANGIBLE, ACROSS THE PRODUCT RANGE. A BROAD VIEW OF SHELF PERFORMANCE AND OF THE MOST EFFECTIVE MARKETING MIX.

Results

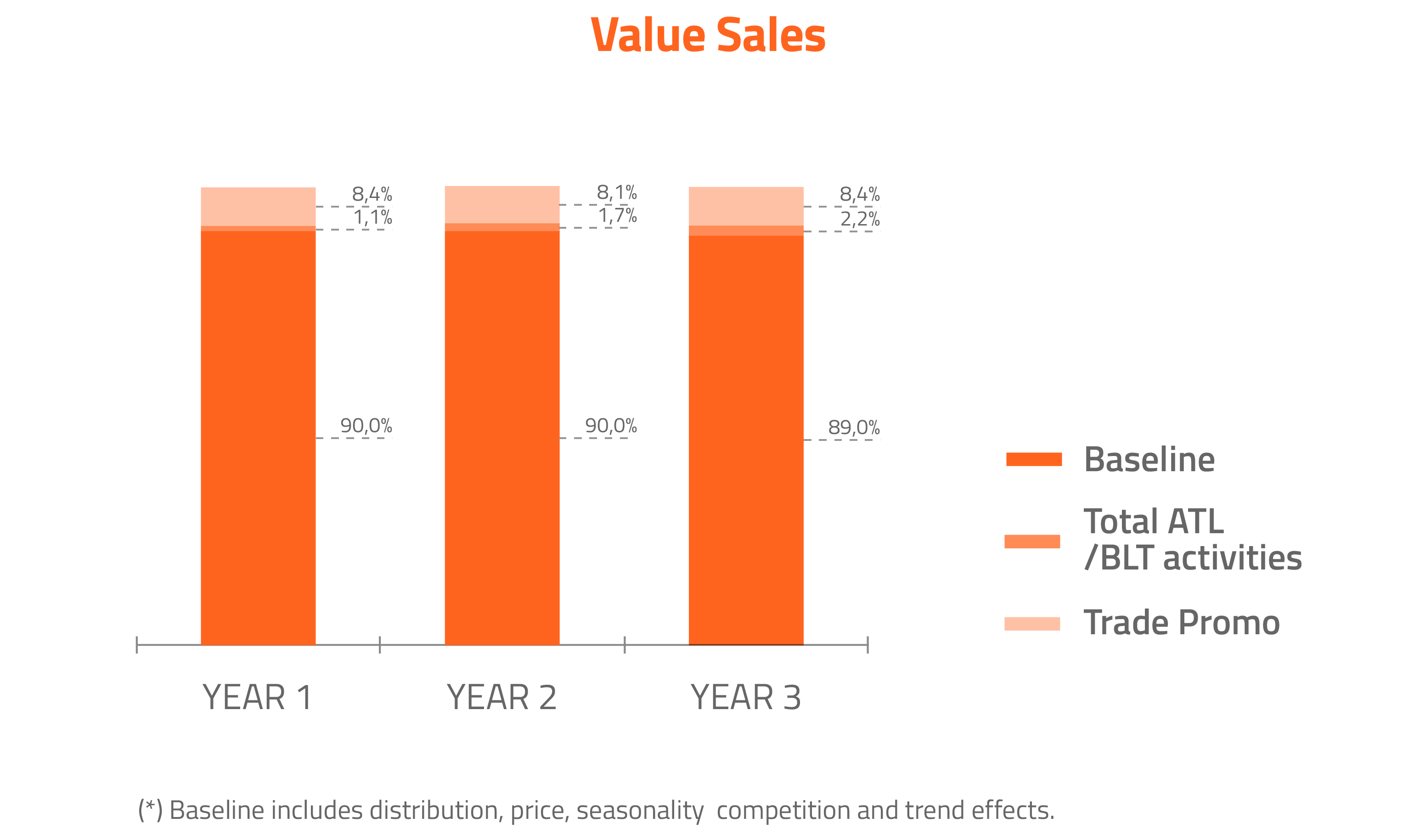

This brand has mainly experienced organic growth over the long-term thanks to wider distribution reach and expansion in the specialties product range, focused on specific needs of animals and thus of higher value.

The short-term effects of media and marketing activities have an ever-increasing impact, although their impact is limited to approximately 10% of the total sell-out.

For this brand, growing thanks to increasing demand in the market, it is necessary to identify the most suitable product offerings, budget settings and marketing levers to activate for each product format.

TAKE AWAYS FOR THE MANAGEMENT

The insights learned from the model enabled management to determine the most effective strategy to adopt for each product format:

400g. Segment – guerrilla marketing with actions limited in time and areas

- For example: multipack promotions to acquire new customers and limit the growth of competitors in the premium sector.

600-1200g. Segment – Reinforcement

-

- Increase distribution and promotions of 800 gr. formats on selected special care segments, after improving positioning of the offer to consumers, in order to increase price elasticity

- Maintain the current promotional policy on other segments

>1200g. Segment – Development through increase in:

-

-

- distribution of two specific items (3 or 4 points)

- promotions for two lines (1 or 2 points)

-

COREFORCAST: DATA ANALYSIS PROVIDING CLEAR INSIGHTS THAT CAN BE APPLIED IMMEDIATELY TO OBTAIN A SIGNIFICANT AND MEASURABLE IMPACT ON BUSINESS PERFORMANCE.

LOOKING TO THE FUTURE

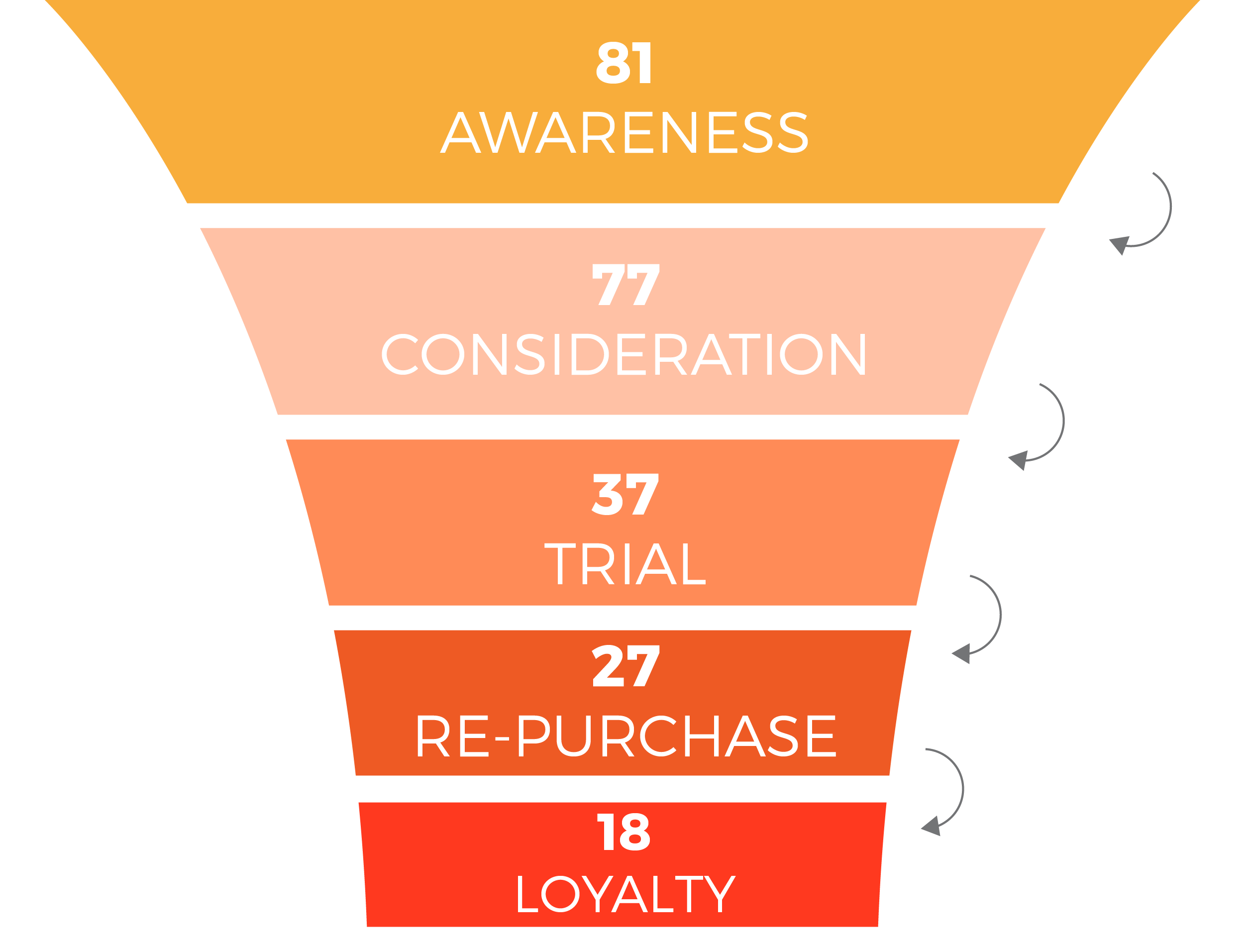

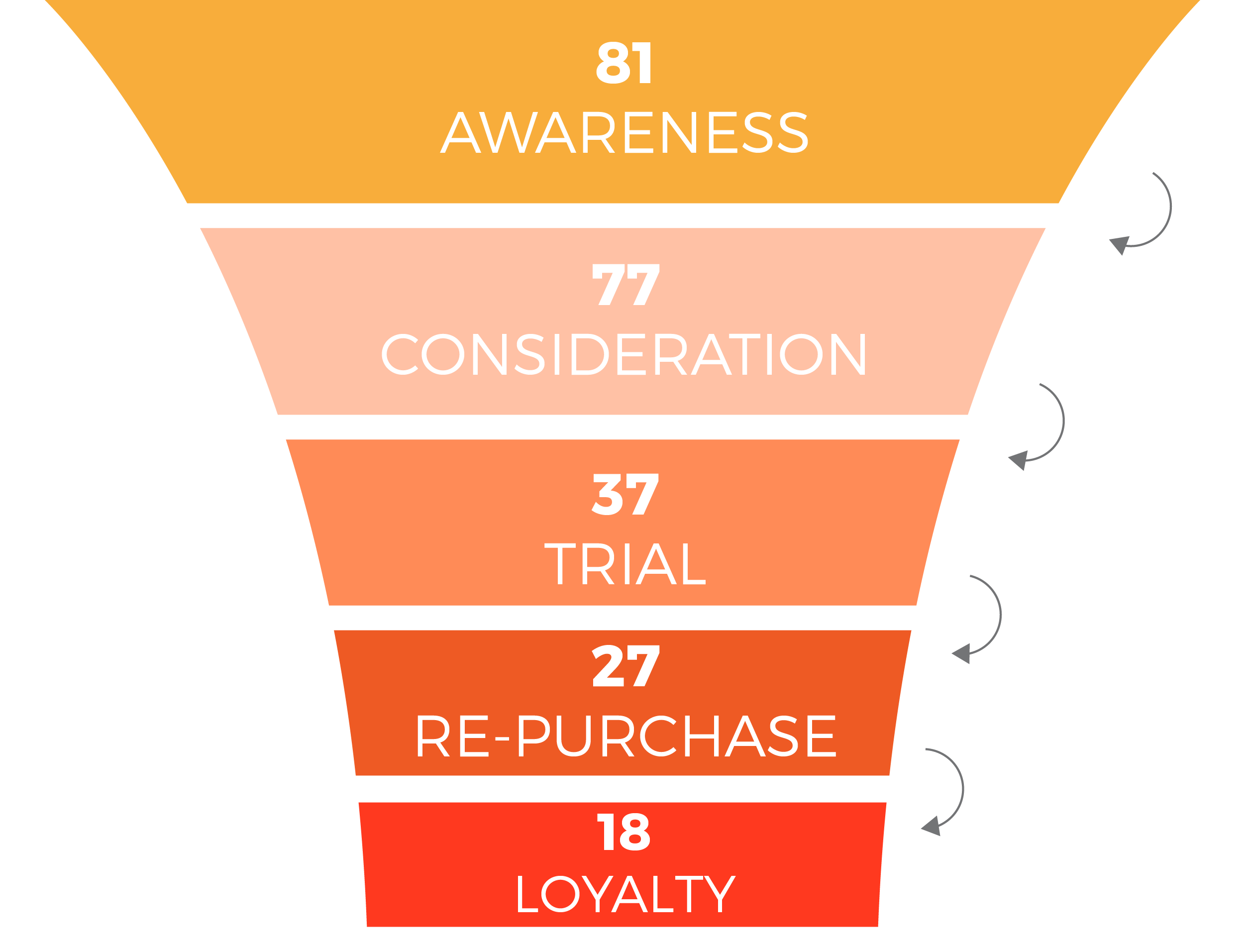

By using Core Forecast, it was also possible to evaluate the available options in terms of distribution or communication, leading to a 1% increase in market share:

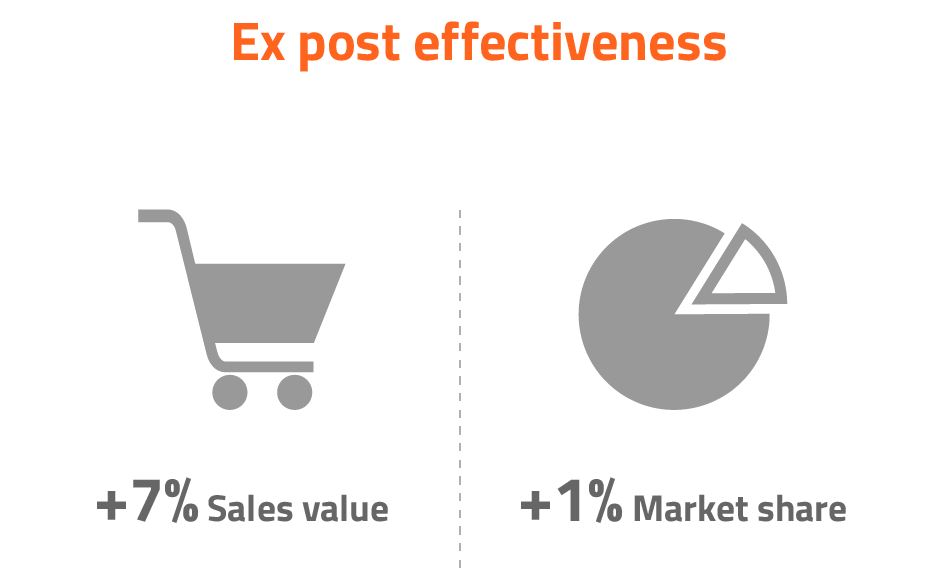

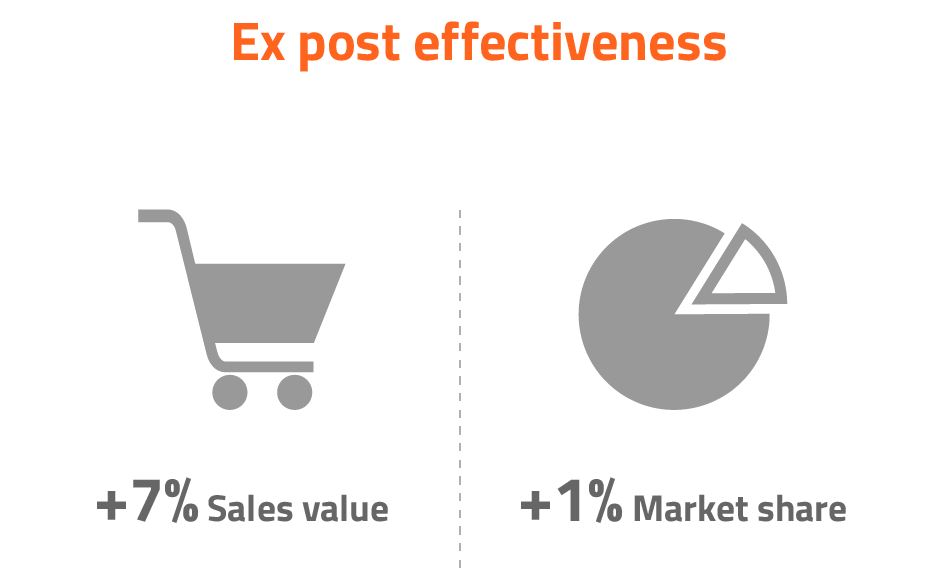

RESULTS

By applying the insights derived from our analyses and modeling, the client’s product portfolio gained 1% in market share and 7% in sales value. The resulting strategy led the company to expand its 800 g. segment, which was more profitable and allowed for a higher shelf rotation, while also consolidating the better-value >1200 g. segments, thus putting an end to previous year’s market share loss.

RESULTS

By applying the insights derived from our analyses and modeling, the client’s product portfolio gained 1% in market share and 7% in sales value. The resulting strategy led the company to expand its 800 g. segment, which was more profitable and allowed for a higher shelf rotation, while also consolidating the better-value >1200 g. segments, thus putting an end to previous year’s market share loss.